Definition and Purpose

DocAssemble isn’t just software; it’s a digital alchemist, transforming the cumbersome paper trails of Fintech into streamlined, automated workflows.

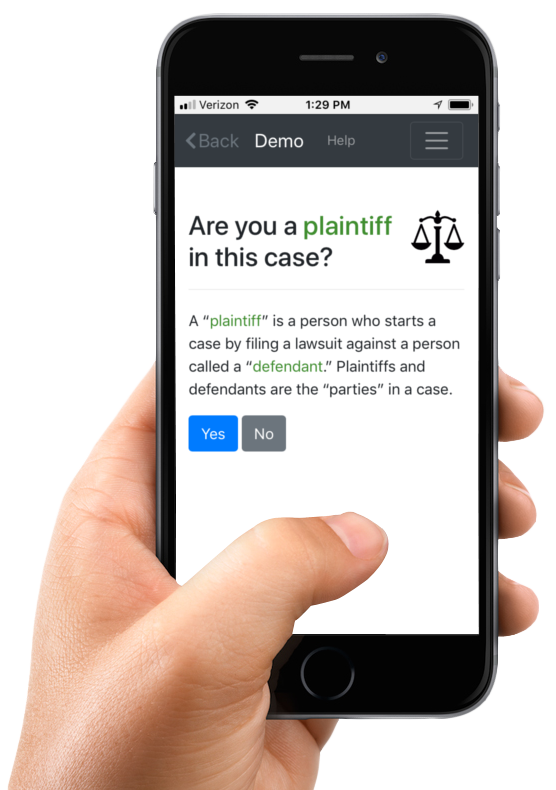

Acts as a digital interviewee, guiding users through customized questions to gather information and make decisions.

Intelligently assembles documents on the fly, like loan agreements or account opening forms, tailored to each user’s unique circumstances.

Connects seamlessly with external data sources for instant verification and risk assessment.

This is the reality that DocAssemble brings to the Fintech industry.

In today’s fast-paced digital world, manual, paper-based processes are simply no longer sustainable. They’re slow, error-prone, and expensive. They frustrate customers and hinder growth.

Fintech companies need a better way. They need DocAssemble.

DocAssemble is a powerful document automation platform that streamlines and automates critical Fintech processes, from loan origination to account opening to compliance. With DocAssemble, you can:

Reduce processing times by up to 80%

Eliminate errors and rework

Improve customer satisfaction

Boost operational efficiency and profitability

In short, DocAssemble is the game-changer that Fintech companies have been waiting for. It’s the key to unlocking faster growth, happier customers, and a more competitive edge.

Looking to integrate DocAssamble in your product?

DocAssemble for Loan Process Automation

Say goodbye to the days of paper-laden loan applications and manual underwriting. DocAssemble revolutionizes the loan process, transforming it from a sluggish marathon into a swift sprint.

Streamlining the Journey from Inquiry to Approval

Dynamic forms: No more one-size-fits-all applications. DocAssemble’s forms adapt to each applicant’s situation, showing only relevant questions and hiding unnecessary ones.

Conditional logic: Decisions are made on the fly. Based on answers, the platform automatically skips irrelevant steps, adjusts interest rates, and even pre-qualifies applicants – all without human intervention.

E-signatures: No more printing, signing, and scanning. Documents are signed electronically, saving time and paper while ensuring a secure and tamper-proof process.

Automating Every Step of the Loan Cycle

Origination: Streamline lead capture, income verification, and document collection with pre-built templates and integrations.

Underwriting: Leverage scoring algorithms, risk assessment tools, and AI-powered fraud detection to make faster, more informed decisions.

Closing: Generate customized loan agreements, disclose terms electronically, and collect e-signatures for a seamless final chapter.

Quantifying the Results

Reduced processing time: Approvals in hours, not weeks, boosting customer satisfaction and conversion rates.

Error rate reduction: Dynamic forms and conditional logic minimize human error, saving time and money on rework.

Cost savings: Lower paper usage, postage, and processing fees translate to significant operational cost reductions.

Let’s discuss how we can enhance your workflows and boost efficiency.

Looking to integrate DocAssamble in your product?

Automate Account Opening with DocAssemble

Imagine a society in which creating a new account is more like a little detour on the way to financial independence than it is like climbing Mount Paperwork. For Fintech organizations struggling with the drawbacks of conventional account opening procedures, DocAssemble gives this reality:

Limitless forms: A pile of documents that overwhelm clients and cause delays in the onboarding process.

Manual verification: Protracted procedures for document verification and KYC/AML checks that cause approvals to move slowly.

Security issues: Sensitive data handling by hand comes with security concerns and compliance issues.

Customers that are frustrated: Customer experience and brand loyalty are negatively impacted by protracted wait times and onerous procedures.

Experience the impact on customer experience:

Instant approvals: Say goodbye to days of waiting. Accounts are opened in minutes, not hours or days, boosting customer satisfaction and conversion rates.

Seamless online onboarding: Eliminate the need for customers to visit physical branches, offering a convenient and accessible experience.

Reduced paperwork: Ditch the paper trail! Secure electronic document handling minimizes environmental impact and improves organization.

Customizing Workflows for Fintech

1. Building in Flexibility:

The real world is messy, and financial journeys rarely follow a straight path. DocAssemble empowers you to handle the unexpected:

Conditional logic: Define alternative workflows for specific scenarios, ensuring a smooth process even for unique cases.

Data validation: Set clear parameters for acceptable data inputs, minimizing errors and preventing invalid submissions.

Human intervention points: Build in options for manual review and intervention where needed, maintaining control over the process.

2. Automated Error Handling and Resolution:

Mistakes happen, but DocAssemble helps you recover quickly and gracefully:

Real-time validation: Identify errors as users enter data, providing immediate feedback and preventing wasted time.

Automated correction suggestions: Offer helpful prompts and guidance to users, empowering them to resolve minor issues on their own.

Escalation triggers: Set thresholds for specific errors or complex cases, automatically notifying human reviewers for swift resolution.

Ready to automate your documents?

New Developments in Fintech Automation Technologies

Integration of AI and Machine Learning

To take automation to a whole new level, DocAssemble is aggressively adopting machine learning and artificial intelligence:

Intelligent document creation: AI can dynamically create customized loan agreements, account terms, and other papers based on user data analysis, doing away with the need for human authoring.

Improved risk assessment: Large data sets can be analyzed by machine learning algorithms to forecast fraud risk, creditworthiness, and other variables. This allows for better decision-making and pricing models that are optimized.

Conversational AI chatbots: Utilize AI chatbots to help users with apps, respond to inquiries, and offer individualized support around-the-clock.